By definition, in a fractional reserve banking system, banks

use high leverages. Nevertheless criticism about the capital structure of banking sector and

its risks expressed after every major financial crisis and bank run; and 2008

global financial crisis was not an exception. We all hear the call to

deleveraging and the frightening stories about how excessive use of leverage in

banking industry lead to not just an unstable financial system, but also a

fragile economy as a whole.

In this blog we will examine these claims and look at the effects of 2008 global financial crisis to the balance sheets of banking sector. We will mainly focus on the European countries. Since the debt crisis in Europe is still an issue, we believe that a deeper investigation would be beneficial for everybody with an interest about the situation of European financial system.

One of the main mistakes that we see in both the layman’s and most of the financial press’ perception of Europe is the tendency to look at these countries as consisting of two very different groups. Namely: the rich north and the poor south. They then expect an alignment in every issue according to this binary paradigm.

In this blog we will examine these claims and look at the effects of 2008 global financial crisis to the balance sheets of banking sector. We will mainly focus on the European countries. Since the debt crisis in Europe is still an issue, we believe that a deeper investigation would be beneficial for everybody with an interest about the situation of European financial system.

One of the main mistakes that we see in both the layman’s and most of the financial press’ perception of Europe is the tendency to look at these countries as consisting of two very different groups. Namely: the rich north and the poor south. They then expect an alignment in every issue according to this binary paradigm.

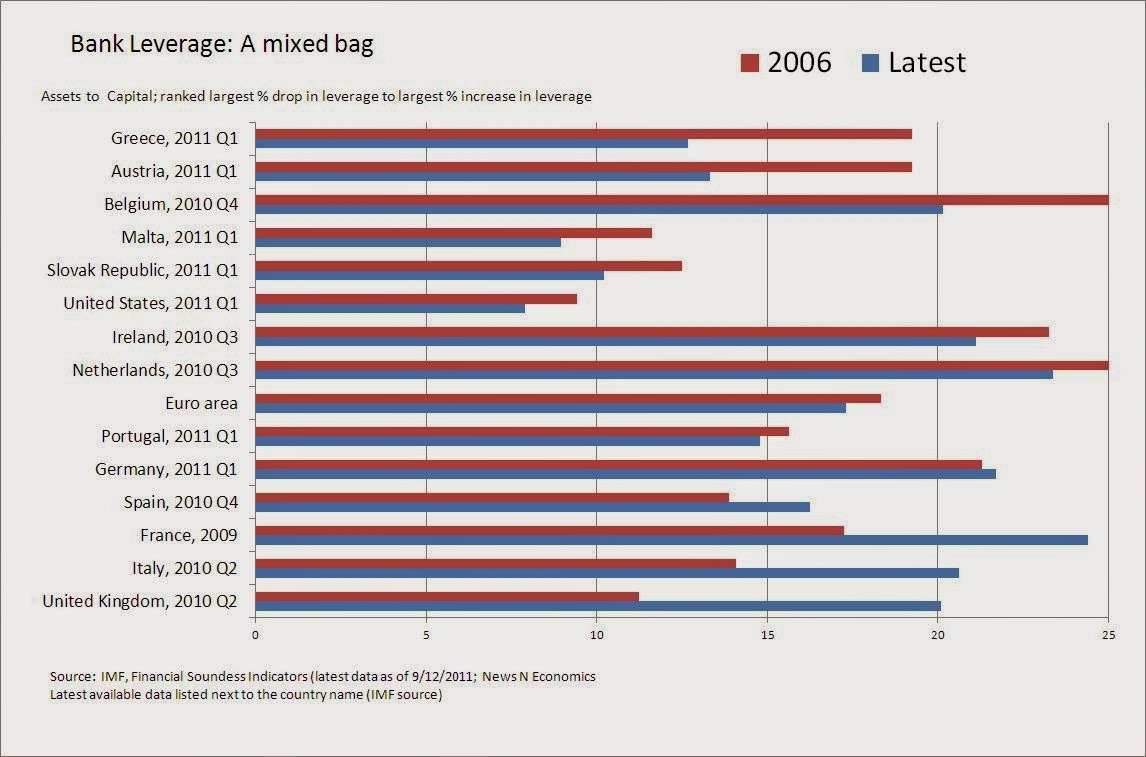

In the case of usage of leverage in banking sector among different

European countries, this story of bi-polarity is simply refuted and we see that

the reality is a lot more complicated. The chart below shows how leverage

ratios vary among countries. It also shows that deleveraging after the

financial crisis is not ubiquitous and there is a significant variation among

countries.

Moreover we’re observing a significant change in the lending

behavior of banks after the financial crisis. The chart below shows that banks

lend increasingly more to governments instead of households or private firms.

There are various reasons for this situation, which I will not investigate

further in this article, but I believe that simply by looking at these figures

we can talk about a crowding out effect.

We're not just observing a change in the balance sheets of the banks but also their activities itself. Today, Banks are not the traditional banks that we know of. Deposit & lending is just a fraction of their business. Shadow banking and capital markets have been increasingly substituting their role as lenders.

We're not just observing a change in the balance sheets of the banks but also their activities itself. Today, Banks are not the traditional banks that we know of. Deposit & lending is just a fraction of their business. Shadow banking and capital markets have been increasingly substituting their role as lenders.

An op-ed article at the Wall Street Journal by AXEL WEBER and SERGIO ERMOTTI

also point at this matter and criticizes the naive focus on leverage ratios:

“There are two ways banks can increase capital ratios: either by increasing capital or by reducing risk-weighted assets (RWAs). A recent paper by the European Banking Authority shows that the Core Tier 1 ratio for 64 EU banks rose to 11.7% in June 2013 from 10% in December 2011. This improvement has come fairly evenly from banks both increasing capital and reducing RWAs.

Within that reduction of risk-weighted assets, there has been an implicit incentive for banks to shift away from capital-intensive corporate lending to less capital-intensive activities, such as lending to governments.

Weak bank lending has been somewhat offset by capital-market activity. The problem is that bank lending still makes up 80% of corporates' total funding mix. Moreover, although debt issuance is an option for large listed companies with reasonable credit ratings, it is not a viable form of financing for smaller companies—let alone individuals.”

As they also point out, because of the riskiness difference

among assets, the importance of leverage ratio becomes questionable. With the Basel

3 standards we will see some interesting developments about this issue.

There is a lot to say and we will try to investigate these issues further in our future posts.

There is a lot to say and we will try to investigate these issues further in our future posts.

References :

- The Wilder View - The European Debt Crisis In 3 Charts

- The 'Silent Austerity' in Banking by AXEL WEBER and SERGIO ERMOTTI

No comments:

Post a Comment