The RoE (Return on Equity), an

internal performance measure of shareholder value was a wrong financial

performance measure. Since RoE is the most well-known performance indicator

widely used by market participants and banks themselves in their disclosures

(i.e. at the top line of bank reports), targeting RoE has exposed banks to

higher unexpected risk levels and opened the door to a more shortterm- oriented

approach to balance sheet management. This ratio was not adjusted

for the risks that financial institutions are taking, i.e. leverage funding and

liquidity profile.

Policies, including Basel I, have

encouraged regulatory arbitrage. Reduced capital ratio minimums incentivized

banks to increase leverage and a significant reduction in reserve requirements

in the 1990s, precipitated lower liquidity and higher leverage. This created

the conditions for a financial crisis we are facing today.

In the years 2002–06 before the crisis, profits were high but several large banks required bailouts. Banks increased profits through both balance sheet and off-balance-sheet growth and by taking on riskier asset/liability mismatches.

1. Return on Equity (RoE):

Return on Equity is the primary

measure banks have pursued to evaluate their performance. RoE used to be very

convenient for bankers. The bank board was given a target RoE which they could

achieve in one or two ways: they could increase the returns or hold the equity

low in the RoE measures. In the banking business they did both at the same time,

high returns and equity low.In the years 2002–06 before the crisis, profits were high but several large banks required bailouts. Banks increased profits through both balance sheet and off-balance-sheet growth and by taking on riskier asset/liability mismatches.

1. Return on Equity (RoE):

RoE = net income / average total

equity

Since mid-90’s the banking sector

was underperforming the utility sector and was not serving the investors very

well. It has bankers let to keep equity to a minimum and made them vulnerable

as enterprises and has made the whole financial system very fragile.

What are proper ways to value the

banks? What are the measures bank management and investors should be focusing

on?

If bankers continue to pursue the

target RoE they should wait for a longer period of years of time to measure if

they have hit the target or not and to reward themselves. If they don’t wait this

period for the consequences of the risks taking with the equity they are given. Than they need to adopt intra measures that are risk adjusted.

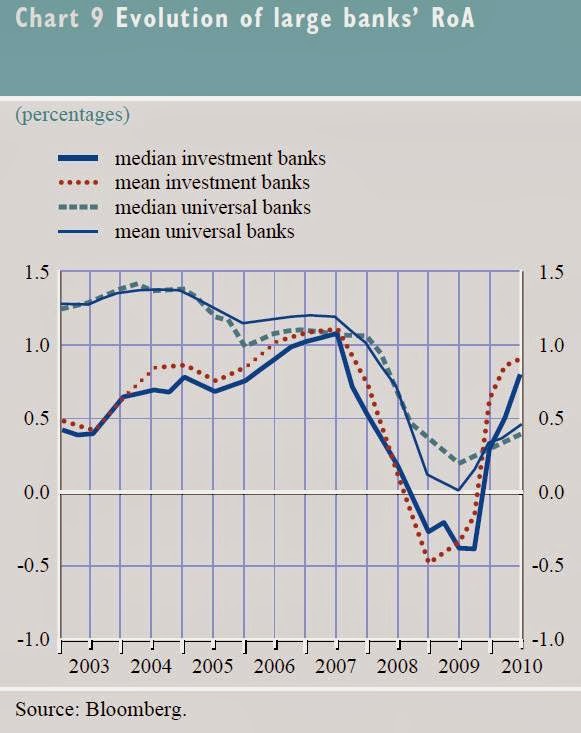

2. Return on Assets (RoA):

Return on Assets (RoA)

is a basic measure of bank profitability that corrects for the size of the bank.

RoA = net income / average total assets

RoA = net income / average total assets

3. Return on Risk-Weighted Assets (RoRWA):

By introducing the measure Return

on Risk-Weighted Assets (RoRWA) the boards and executive management needs to

focus on the issue of risks. What risks are banks taking, what order of magnitude,

what are the potential outcomes, in which area. These risk weights come out of Basel

regulations, exposure against which they are measured are generated by the

banks themselves. Since the crisis there are new Basel regulations, Basel III

which is an improved version of Basel II/2.5. Now also capital and liquidity

requirements, including the Tier I capital leverage ratio, liquidity coverage

ratio, and the net stable funding ratio are primary measures of a bank.

But are these Basel-driven risk

weightings right? Does a bank board need to judge these weightings themselves? Which

other measures do we need to take into account to let banks better perform than

in the past? The RoE was the primary measure of many banks which they pursued

in terms of the profitability objective, the capacity to generate sustainable

profitability. We have seen that it has not contributed to long-term

shareholder value. Instead it has contributed to volatility of returns, excessive

leverage, risk-taking which has made our financial system very unstable. This

has encouraged the banks to keep the equity small as possible and the leverage

as large as possible and has made the financial system fragile. Today, it is very

important to promote financial stability. We have to create well regulated

banks that are more prudent. It means more equity in the mix and having the

right targets to encourage them.

We are investigating how the RoE

changed before, during and after the crisis. What are the main drivers

explaining the RoE changes over the crisis? What are appropriate performance

measures after the financial crisis? Are the Basel regulations good policies or

do need banks themselves consider other measures. Are stress testing programs imposed

by Basel a good tool to supplement other risk management approaches and

measures?

No comments:

Post a Comment